Why choose us as your partner for risk management?

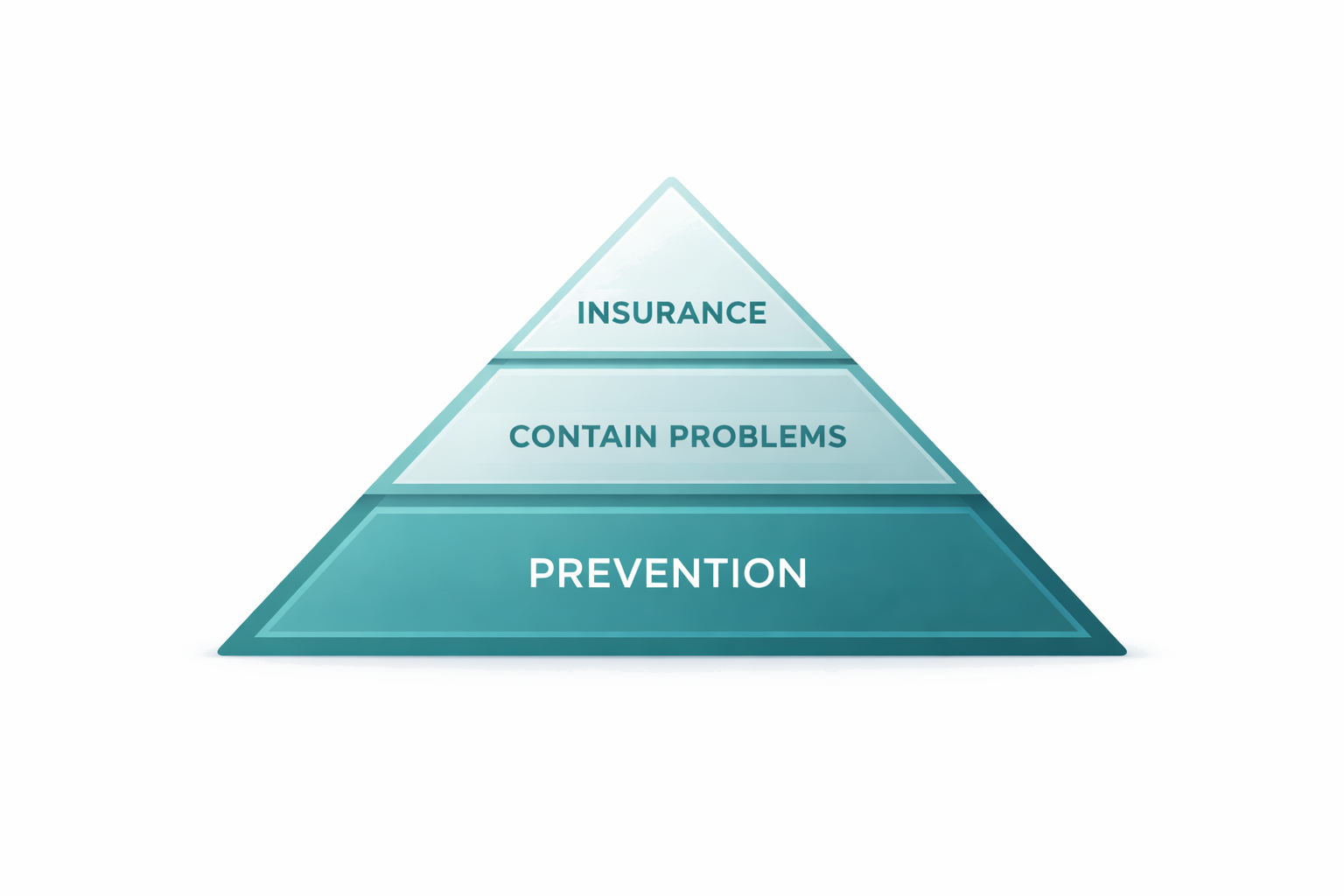

A relationship with shared goals of prevention, reducing claims frequency, and overall reducing total cost of risk

We focus on prevention

We're a brokerage built for business owners who want fewer claims, fewer surprises, and more control. We focus on prevention first, rapid problem containment when things happen, and using insurance as the final layer of protection, not the starting point.

Not working with us

Your cost of risk could be higher than it needs to be. When risk isn't managed intentionally, the cost doesn't show up in just one place. It shows up everywhere: higher premiums, more claim friction, operational distractions, and a reputation with underwriters that's harder to defend at renewal. If your business looks "average" on paper, underwriters price you like everyone else—higher rates, tougher terms, and less flexibility.

How we step in

We'd love to work with you on the insurance, but this isn't about just the policy. We bring practical tools and a proven process into your business to reduce risk, improve outcomes, and help you run tighter operations.

And here's the important part: you're already paying for insurance. That premium goes to the carrier—not to us. Our value is in being your risk advisor and partner, helping you implement the resources that make your business look and operate like best-in-class.

Actionable items implemented through our partnership

Risk management driving results for your organizations

Our focus is proactive risk support, and real partnership—so you can keep operating with confidence, even when the unexpected happens.

We help you tighten the things that drive losses: jobsite checklists, safety habits, driver controls, documentation templates, and simple processes your team will actually follow. Fewer incidents means fewer claims — and fewer claims is one of the fastest ways to protect your pricing long-term.

Insurance companies price what they can understand and trust. We help your business look "best-in-class" on paper with clean operations details, prioritization of safety, clear scope descriptions, and a stronger underwriting narrative — which can lead to better eligibility, more favorable terms, and stronger coverage options.

We've invested heavily in the technology needed provide you data, tools, and human capital to drive change in your organizaiton.

Coverage built on partnership

We don't just place your insurance policy—we help strengthen your processes, reduce risk, and keep your business protected as you grow. Hit Get a Quote, fill out the form, and we will reach out.